Explosive, New Unredacted Report by CA Commission about AT&T California

Corroborates IRREGULATORS Call to Investigate Billions of Cross Subsidies.

Over the last few weeks, a senior citizen named Aaron Epstein defied the odds. He was so frustrated with his old copper based DSL service and not having a high-speed fiber connection from AT&T California that he took out ads in the WSJ for a hefty $10 grand — and in days, he had humiliated AT&T into connecting him to their AT&T Fiber service.

But what about the other 17.8 million residential customers in AT&T California territory or the 70+ million in the 21 states where AT&T controls the largest public telecommunications utilities in each state?

You probably didn’t know that there are still state utilities left throughout America or that AT&T was supposed to have brought fiber to California in 1995. Customers, in fact, started paying rate increases in the 1990’s to paid for it. Mr. Epstein should have already been enjoying high speed service from AT&T.

In October 2020, the IRREGULATORS filed with the CA Broadband Council and CA Public Utility Commission (CPUC) claiming that AT&T most likely has been overcharging customers billions of dollars annually, and that it has been taking the construction budgets that should have been dedicated to the cities and homes in California and instead has been diverting them to wireless instead of upgrading the state telecom utility.

Moreover, there has been a series of financial shell games that were created over the last 2 decades that has made the state utilities cash-cows to pay for all of the other lines of business that also use these networks and this includes fiber optic wires. Our CA analysis was based on research of another state utility, Verizon NY, which we have been investigating for a decade.

Coincidentally and ironically, as if on cue, a long awaited report series “Examination of the Local Telecommunications Networks...” has finally been released about AT&T California and Frontier (formerly Verizon CA), by the California Public Utility Commission and created with the respected research firm, Economics & Technology.

Some Findings from the CA Reports

NOTE: The utilities are not just about the copper wires but all wires and all services in the AT&T CA territory as they should have been replaced with fiber over the last 3 decades.

Extraordinarily Large Rate Increases & Harvesting

- “A succession of rate increases has continued… and by the end of 2017 AT&T California’s rates for flat-rate and measured residential POTS (Plain Old Telephone Service) access lines had risen to 152.6% and 325.4% of their 2009 rates respectively.”

- “Harvesting” is AT&T California’s overarching strategy for its legacy services and customers.

- NOTE: “Harvesting” is a when a company has loyal clients and decides to discontinue the service so it continuously raises rates until they either scream uncle and leave — to another product owned by the same company, such as wireless, or they get gouged until the service is no longer being upgraded.

- As of December 31, 2017, AT&T served approximately 2,245,171 residential and small business legacy circuit-switched (POTS) access lines.” (NOTE: This is a fraction of the total copper lines in use.)

Not Based on Actual Costs

- “The succession of annual rate increases applicable to AT&T California’s legacy POTS services were not in any sense cost-driven or cost-based, and instead appear to have been driven by the company’s pursuit of a harvesting strategy with respect to these services.”

Deteriorating Service Quality

- “The quality of AT&T … voice services has steadily declined over the 8-year period from 2010–2017 that is covered by this examination, with the number of outages increasing and the service restoration times getting longer.”

Persistent Disinvestment

- “Over the full 2010–2017 period, less than 1% of all AT&T capital spending on network plant additions, just under $47-million, was for outside plant rehabilitation projects.

- “Extraordinarily small portions of AT&T California’s Plant Additions and Maintenance expenditures have been directed at legacy POTS (Plain Old Telephone Service) services over the 2013–2017 period.”

Massive Financial Cross-Subsidy Scheme with Other Affiliates.

- “AT&T California financial statements show an incomplete assessment of the ILEC’s financial condition due to the large volume of inter-affiliate transactions made at transfer prices that are not set on the basis of arm’s length negotiations.

- NOTE: “ILEC” is the “Incumbent Local Exchange Company”, another industry name for one of the state telecommunications utilities that controls the based wired infrastructure in a city or state.

- “The AT&T California ILEC entity engages in extensive intra-corporate purchases from and sales to a number of other AT&T affiliates. Since both the seller and buyer are wholly owned by the same parent company…setting an inflated transfer price can accomplish this as effectively as making a dividend payment to the parent, but with far less exposure.”

The State Telecommunications Utilities Are All of the Wires and the Supplies the Primary Infrastructure for All of the Affiliate Services.

- “AT&T California remains the underlying provider of most retail local network services being offered under the AT&T California or other AT&T affiliate brand names. Broadband Internet access is provided utilizing many of the same AT&T California network facilities as POTS. Bundles of circuit-switched local and long distance telephone service are furnished jointly by AT&T California and by AT&T’s long distance affiliate. From its recent acquisition of DirecTV, AT&T is also offering bundles of voice, Internet and satellite TV services furnished by several affiliates.

- NOTE: The largest affiliate ‘transfer’ is between and among the state utility and AT&T Wireless, which is not focused on.

The Affiliates Should be Paying Market Prices for Use of these Networks

- “Mechanically, and with the exception of tariffed switched and special access services, each of the providing affiliates will ‘purchase’ the underlying network services and functions, including billing and collection services, from AT&T California at mutually-agreed-upon prices.”

Where’s the Fiber Optic Upgrades?

- “Out of nearly 17.8-million homes passed within AT&T California’s operating areas, only about 315,000, or 1.8%, are currently served with fiber-to-the-premises technology as of 2017.

- “Notably, the county with the highest FTTP penetration — Santa Clara — is still at only 7.6%, while its neighbor in Silicon Valley — San Mateo — shows FTTP penetration at 0.0%.”

Social Injustice; Digital Divide Violations

- “AT&T is focusing on higher income communities — AT&T wire centers serving areas with the lowest household incomes exhibit higher trouble report rates and longer out-of-service durations than areas in higher income communities.”

To Sum Up the Harms, the Report States

“Persistent disinvestment, extensive affiliate transactions at self-serving transfer prices, extraordinarily large rate increases, and deteriorating service quality all point to ‘harvesting’ as AT&T California’s overarching strategy for its legacy services and customers. These extensive affiliate transactions, the directly measurable indicators of disinvestment — depreciation accruals that exceed gross additions, payments of dividends to the parent company that exceed the nominally reported net income, and the persistent erosion of AT&T CA’s Net Plant — and the deteriorating service quality overall, together compel certain conclusions as to AT&T California’s overall financial condition and investment policies.”

We will return to these issues and add some clarity in a moment.

BACKDROP: IRREGULATORS CALIFORNIA FILINGS

In September 2020, California Governor Newsom released an executive order to develop an “action” plan in order to solve the Digital Divide by upgrading all of California with broadband, capable of 100mbps download speeds, at affordable prices. The California Broadband Council has been collecting comments about the Newsom plan as well as the CA Public Utility Commission (CPUC).

Click to Read the Filing On October 26th, 2020, the IRREGULATORS filed reply comments with the CPUC, as well as the CA Broadband Council to go after $1.7-$2.4 billion in potential overcharging annually of Local Service, by AT&T, the primary state telecommunications public utility.

We also pointed out that the Verizon NY annual reports, which are public, are based on the FCC’s accounting rules known as the USOA, ARMIS. Moreover, we uncovered literally billions of dollars of overcharging because the accounting rules now made the state wired utility unprofitable, which, in New York, caused rate increases; the financial reports clearly show massive cross-subsidies of the company’s subsidiaries and the Verizon NY state utility.

And we pointed out that AT&T California appeared to be using the same USOA-ARMIS accounting as New York and combined with decades of research, we called on California to start investigations into halting the cross-subsidies and use the billions to properly upgrade the state with fiber optics.

New California State Research Is Either Hidden in Plain Sight or Misunderstood.

As we discuss, our filing contains items that have been independently corroborated; the State’s report supplies additional, separately created analyses that come to the same conclusions.

Data had been Redacted: While released as a redacted analyses in 2019, after a decision in December 2020 to unredact the basic financial information, at the end of January 2021, extensive research by the California Public Utility Commission and using Economics and Technology (ETI), was finally released. It includes the condition of the communications networks, the Quality of Service (QoS) issues, and what services are currently being offered. It also examined the price of service and some of the issues surrounding the AT&T affiliates that are also using the networks.

- “Examination of the Local Telecommunications Networks and Related Policies and Practices of AT&T California and Frontier California, 2010–2017 (Network Exam) Network Exam — ordered by Decision (D.) 13–02–023.”

This is divided into separate chapters with the whole document containing 619 pages.

And this has been going on since 2010. The State wrote:

“The Commission initiated this rulemaking proceeding in response to a Communications Division (CD) staff report, which found substandard results in service quality filings by carriers subject to General Order (GO) 133-C, which sets forth service quality standards for wireline telecommunication corporations. This rulemaking assessed performance standards in 2010 and was initiated to determine whether the GO 133-C standards were adequate and whether the Commission needed to adopt a penalty mechanism for substandard service quality performance.”

“In December 2011, the California Public Utilities Commission (CPUC) opened Rulemaking (R.) 11–12–001 to (a) review telecommunications carrier performance in meeting the GO 133-C/D service quality standards and measures in 2010; (b) assess whether the existing GO 133 C/D service quality standards and measures meet the goals of the Commission to adequately protect California customers and the public interest; © determine whether the existing GO 133-C/D standards are relevant to the current regulatory environment and market; and (d) determine whether there is a need to establish a penalty mechanism for substandard service quality performance.”

And if you want screwy — the report was completed in 2019, it appears, but the publication was held up — this is one of the caveats from the earlier versions:

“Nearly all of the information contained in the various AT&T California and Frontier California (including former Verizon California) data files, responses to data requests, and other source material (“ILEC Data”) that has been provided to ETI in the course of this examination has been identified by the carriers and/or by the Commission as CONFIDENTIAL AND PROPRIETARY AND SUBJECT TO CPUC GENERAL ORDER 66, PUB. UTIL. CODE SECTION 583 AND D.16–08–024, REGARDLESS OF WHETHER O NOT A DOCUMENT OR FILE HAS BEEN EXPRESSLY LABELED AS CONFIDENTIAL. Under the terms of our Agreement no. 17PS5007 including the incorporated Confidentiality of Data/Nondisclosure Agreement (Section 9. Exhibit E), all of the contents of this report are, by default, being treated as CONFIDENTIAL AND PROPRIETARY ILEC DATA whether or not expressly identified as such.” (The Caps is how it appears.)

On December 21, 2020, a “new decision allows for public inspection of various parts of AT&T and Frontier’s financial reports”.

- “New: Decision (D.) D.20–12–021, Decision Addressing Carriers’ Confidentiality Claims Related to Network Study Ordered in Decision 13–02–023, as Affirmed in Decision 15–08–041.

“Decision 20–12–021 addresses the confidentiality claims of AT&T California and Frontier California in relation to the Network Exam. The Decision orders a majority of the Network Exam Report to be made public. The Commission directs staff to make limited redactions to information that, if revealed, could pose a security risk…. Accordingly, no redactions were made to Chapters 5, 6, 7, and 8. Please see below, for the complete report.”

What is even more shocking is that we could find no stories or analyses using the financial reports; Governor Newsom’s plan does even not mention AT&T or the findings from this report, and none of the current proposed pieces of legislation mentions the report or the findings or going after the cross-subsidies or…

Independent corroboration of most of the IRREGULATORS’ filings in California adds significant new weight and facts about AT&T California.

Here are some points.

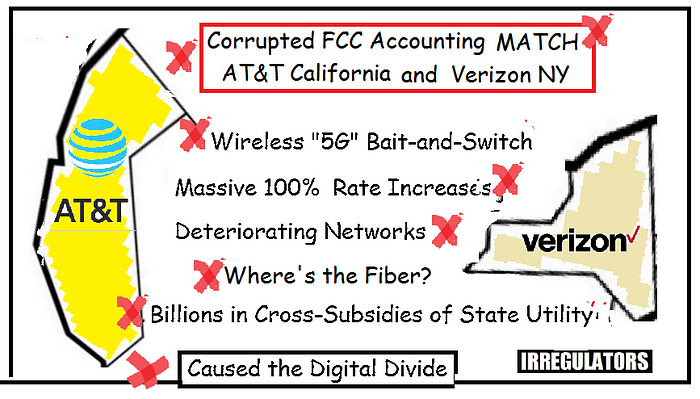

1) AT&T California and Verizon NY Match: AT&T is using the FCC corrupted USOA-ARMIS rules and formulas which are identical to Verizon NY.

Our analysis has been based on the assumption that AT&T CA is using the FCC’ formulas just like NY and therefore, they should have the same overcharging and cross-subsidies. — and we were right.

CA Report States

- “Category 4: Annual financial reports AT&T California, Verizon California, and Frontier California file with the CPUC that conform to the Federal Communications Commission’s Automated Regulatory Management Information System (ARMIS) reporting requirements. While largely discontinued by the Federal Communications Commission (FCC) after 2007, the CPUC has continued to require these reports to be filed by Uniform Regulatory Framework Incumbent Local Exchange Carriers (ILECs).”

2) What We Filed and What They Wrote

CPUC-ETI statement about the overall issues; To return to the last quote:

“Persistent disinvestment, extensive affiliate transactions at self-serving transfer prices, extraordinarily large rate increases… and deteriorating service quality all point to “harvesting” as AT&T California’s overarching strategy for its legacy services and customers and investment policies.”

Rephrased, these are the exact same items featured in our filings in CA.

- There are added ‘extraordinarily large’ rate increases to ‘Harvest’ customers.

- AT&T lowed investment, which helped the networks to deteriorate and lower service quality.

- AT&T created sweetheart deals with all of the other ‘subsidiaries’ so that they do not pay market prices as competitors would.

3) Major Continuous Rate Increases: 153%-325%, CPUC-ETI

“The 2006 URF decision allowed California’s large ILECs to detariff most of their retail services. As we discussed… as soon as detariffing of residential rates took effect in January 2009, AT&T implemented a 26.3% rate increase for flat-rate residential service and a 27.7% increase for measured residential service.

“A succession of rate increases has continued ever since, and by the end of 2017 AT&T California’s rates for flat-rate and measured residential POTS access lines had risen to 152.6% and 325.4% of their pre-URF levels, respectively.”

IRREGULATORS wrote: (based on survey of actual bills.)

- The price of the basic AT&T California state utility phone service went up 143% from 2004–2016.

- The price of every ancillary service went up, from Call Waiting, which went up 240%, to unlisted numbers, which went up 525% (a fact that was also uncovered by the LA Times in 2016.)

4) No Upgrades or Even Maintenance of the Copper Networks for a Decade?

CPUC-ETI

“Over the full 2010–2017 period, less than 1% of all AT&T capital spending on network plant additions, just under $47 million, was for outside plant rehabilitation projects.

“Extraordinarily small portions of AT&T California’s Plant Additions and Maintenance expenditures have been directed at legacy POTS (Plain Old Telephone Service) services over the 2013–2017 period.

Yes, this says that AT&T spent under $50 million to maintain and repair the basic entire network in California for 8 years. The information stops in 2017.

5) Higher Income Communities are the Focus

CPUC-ETI

“AT&T is focusing on higher income communities — AT&T wire centers serving areas with the lowest household incomes exhibit higher trouble report rates and longer out-of-service durations than areas in higher income communities.”

IRREGULATORS Filed

“Seventh, the companies have been mainly serving the wealthy areas, and this is a social injustice and caused the Digital Divide. A Haas Institute study had a number of disturbing findings about California. ‘Rural California is left behind by AT&T. In 14 largely rural counties, virtually no household has access to AT&T broadband at the FCC’s 25/3 Mbps speed and one-third or more households are underserved without access to AT&T broadband at 6/1.5 Mbps.”

6) Cross Subsidies between AT&T California and the AT&T Subsidiaries

We have called for audits of the current cross-subsidies, assuming the financial reports are using the same accounting rules… And they match, but New York is much more extensive, at least as presented in this report. However, it is clear that what we found in NY is identical to all of the ‘Bell Companies’, which includes AT&T California and all of the other AT&T territories, we assume.

CPUC-ETI Report

- “But even AT&T California’s nominally reported revenues, expenses and net income cannot by themselves provide a complete or accurate picture of the company’s financial performance. The AT&T California ILEC entity engages in extensive intra-corporate purchases from and sales to a number of other AT&T affiliates. Since both the seller and buyer are wholly owned by the same parent company…setting an inflated transfer price can accomplish this as effectively as making a dividend payment to the parent, but with far less exposure.

“In four out of the last five years, more than 50% of AT&T California total operating expenses net of depreciation and amortization were paid over to other AT&T affiliates for services rendered. That this type of manipulation may have occurred is hardly idle speculation. In fact, AT&T and its post-1984 RBOC offspring have a long history of such transactions. In California…”

What we found and what this implies is that the subsidiaries have sweet-heart deals so that they do not pay the expenses or the fees that a competitor would pay if they, too, used these networks.

7) No Audits Or Investigations for Decades

As the IRREGULATORS pointed out, in the 2013 Annual Digital Infrastructure and Video Competition Act of 2006 DIVCA Report, (we summarize):

- The California PUC has not investigated AT&T’s cross-subsidization of services, even when the Office of Ratepayer Advocates (ORA) raised the matter years ago. The Commission claimed that the FCC’s accounting, known as ARMIS data, did not include data to determine if there were violations,

- The Commission even claimed that it would be too “onerous” to do an audit, and worse, there has not been an audit done for decades because of the New Regulatory Framework, which was created in 1998, though there were audits that found overcharging during this period.

8) AT&T Is Still Largely Copper Wires

Moreover, the networks are still mostly copper — but, are used for U-verse and DSL.

“AT&T’s outside plant distribution network is still largely copper-based. AT&T utilizes mainly twisted-pair copper in its distribution infrastructure, extending fiber optic cables only to “Nodes” in individual neighborhoods. This is done in order to reduce the physical length of the copper segment and allow the provision of Digital Subscriber Line (DSL) at higher speeds than would be possible if the copper loop spanned the entire distance from the wire center facility to customers’ homes. 48.9% of the homes covered by AT&T are served by this “Fiber-to-the-Node” (“FTTN”) network architecture.

“AT&T has deployed some Fiber-to-the-Premises (“FTTP”) facilities in a small number of wire center areas and, where deployed, to only a small number of customer locations. FTTP technology is currently available to only about 315,000, or 1.8%, of the nearly 17.8 million homes within AT&T California’s operating areas.”

Caveats to these Numbers:

While we understand the presentation, there are problems with these numbers. The report focuses on POTS, Plain Old Telephone Service, which uses the copper wires for basic phone service.

IMPORTANT: “As of December 31, 2017, AT&T served approximately 2,245,171 residential and small business legacy circuit-switched (POTS) access lines.”

But, all of the wires, including the u-Verse fiber node, then, are using the existing copper but these are not counted as lines. Even though it is an identical wire, the actual classification changes based on the service using the network — i.e., u-Verse is an ‘information’ service; the line is no longer counted as a ‘telecommunications’ service.

U-Verse is supposed to pay for the use of the copper phone wires — but there is no indication that it happened at ‘market prices’.

CONCLUSION

In the end, continuous rate increases of 150% shows that the copper wired networks are not competitive and that the actual cost to offer the service is made up to ‘harvest’ customers. The price should have plummeted based on a) the networks were written off and b) there was only $50 million dollars over an 8 year period spent on maintenance.

But this isn’t about the copper — it is about the fact that the telecom utility has been used as a cash machine for all of the other AT&T activities and AT&T DID NOT bring fiber optic broadband to the State as promised.

But, at the same time, AT&T and Verizon manipulated the FCC cost accounting rules to make the networks appear unprofitable or to fund the other lines of business.

At the core: AT&T’s plan is to shut off the copper, then force-march customers onto more expensive wireless — which requires a fiber optic wire.

This is why Aaron Epstein didn’t get fiber but had to resort to spending $10 grand for an advertisement

And it is why there is a massive Digital Divide in California — because AT&T never upgraded the networks to fiber optics.

This independent in-depth financial analysis by the CPUC and Economic & Technology corroborates the IRREGULATORS call for investigations and it lays out the same massive harms that need immediate attention.