The Mergers that Created AT&T & Verizon Were Failures. — Time to Break Up AT&T…Again.

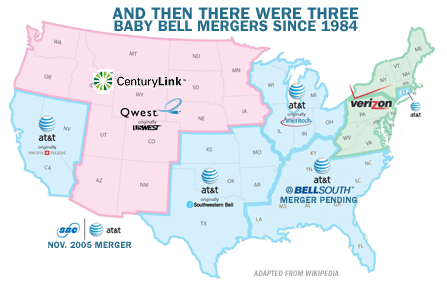

- AT&T = SBC, Southwestern Bell, Pacific Telesis, SNET, Ameritech, BellSouth and AT&T.

- Verizon = Bell Atlantic, NYNEX, GTE, Alltel, and MCI

- CenturyLink = US West turned into Qwest

For the full story, read: “The Book of Broken Promises; $400 Billion Broadband Scandal & Free the Net”, now a free download.

In 1984, the original AT&T (“Ma Bell”) was broken up because of its monopoly power over America’s telecommunications services and critical infrastructure. Known as “Divestiture”, the company controlled most of America’s wireline services as well as “long distance”, (calls that cross state lines). GTE, SNET and Alltel were then independent, incumbent telecom utilities and covered 15–20% of US territories. But, by the 1980’s it was clear that America needed competition to bring new and innovative services, as well as lower prices, especially for long distance.

After years of legal wranglings and cases, (one of which involved a long distance upstart, MCI) seven ‘Baby Bells” were created. Known as “RBOCs”, “Regional Bell Holding Companies”, each regional Bell would control a group of states. Meanwhile, AT&T was spun off and it kept the long distance business and would later also offer internet and local phone service, as would MCI.

However, the wires were still monopoly-controlled so Congress passed the Telecom Act of 1996, which was supposed open the incumbent, state-based telecommunications utility networks to direct competition. The Bell companies did not open the networks for free. They would be rewarded by being allowed to enter all other lines of business, like long distance, cable TV or internet service. (When the RBOCs were created it was feared that they would ‘vertically integrate’ and give advantages to all of their other services, to the detriment of competition.)

Moreover, starting in the 1990’s, America was supposed to be upgraded with fiber optics, state-by state, by replacing the existing state utility copper wires. By 2010, America should have been a fully-fiberized nation covering rural, urban and suburban areas, and have robust competition. The companies collected an estimated $½ trillion dollars to do these upgrades by 2017 (and that’s the low number).

Unfortunately, starting in 1996, the Bell companies, instead of competing, decided to marry their siblings; an act against nature, and they did not upgrade most of the networks. By 2005, the networks, with the help of the FCC, were closed to most competition and by 2007 only three consolidated companies — AT&T, Verizon and Centurylink — were left standing, each with their own wireline fiefdom that did not compete, and a long trail of broken promises and direct harms to customers. However, in every merger they claimed they would be attacking each others’ territories with wired phone and broadband/internet competition. Never happened.

Some broadband was deployed, starting in 2006:

- AT&T rolled out U-Verse and told the public it was a fiber-optic service, only to find that it was a copper-to-the-home service, using the existing state utility wires, with a fiber optic ‘node’ within ½ mile from the premises.

- Verizon would roll out FiOS, a fiber optic service, but it would be done as “Title II” and part of the state utility to be charged to phone customers as an upgrade. Verizon finished less than ½ the territories, leaving massive holes, and cities not upgraded, as told by a current lawsuit by NYC, which claims 1/3 of the deployment that was supposedly complete was not, leaving over 1 million homes un-upgraded.

Over the last few years, AT&T would purchase DirecTV, among other companies, and in 2018, it now hopes to buy Time Warner. Verizon would buy up AOL and Yahoo. And in 2018, both claim they are now ‘wireless-first’ entertainment companies. Few understand that they still control the wired utilities that were left to deteriorate instead of upgrading most of their state territories to fiber optics, and these networks are mostly closed to direct competition, with the FCC planning on finishing the job. Meanwhile, the utility assets that are upgraded are being moved to offer wireless.

Verizon Wireless & AT&T Wireless? There has been a whole series of other mergers that created these wireless companies but at the core are 3 core facts: 1) These two wireless companies were created with the help of funding via charging the wireline customers. 2) They have also been able to use the wireline utility construction budgets and staff to build out the wireless networks and not pay market prices to use the networks. Most important: 3) Almost all wireless services, including 5G, require a fiber optic wire that is attached to the cell site — every block or two.

This has made the wired networks artificially appear to be unprofitable, while goosing the profits of AT&T and Verizon’s wireless companies.

And while technologies change, the fundamentals haven’t. Verizon, AT&T and CenturyLink still control most of the US state utilities, and these wires are still mostly monopolies, and the companies have been able to add lots of new services and get the benefits of being utilities, but have fooled America into thinking that they are ‘free market’ companies. Worse, this FCC is owned and operated by these few companies and it is removing all regulations, obligations and any oversight — based on a plan laid out by AT&T in 2012 and handed to now-FCC Chairman Ajit Pai (and tied to the American Legislative Exchange Council, ALEC’s “model” state legislation).

We are at the end game and we need to break them up…again, before it is too late. Net Neutrality, privacy issues, the price of service, the Digital Divide, competition, etc. are all tied to a few companies taking control over publicly-funded infrastructure and manipulating the public policies.

The cable companies? We also need to deal with opening and fixing the cable networks. But with the the manipulation of the accounting to make the utility networks look unprofitable to feed the wireless companies’ profits and FCC’s public interest attacks to ‘shut off the copper’, and remove any obligations on the wired networks…

It is time to separate the utility wires, including the fiber optic wires customers paid for, from all of this entertainment, ad-tech, customer tracking, wireless data cap, etc., and make the companies pay market prices for using the networks — a second “Divestiture”. We need to reopen the pipes we all paid for to full competition and help state utilities and municipalities upgrade everyone, everywhere… now. Just read what happened and examine the facts. (This is only a partial history and we left out many twists and turns. Read “The Book of Broken Promises”.)

SUMMARY: The Creation of AT&T & Verizon: Broadband Commitments & Closures

The Bell mergers should act as a guide to future mergers pointing to one important fact: the statements, commitments, enforcement of those commitments and the outcomes never matched what was expected to occur in the public interest. Without serious commitments and enforcement of those commitments, the benefits of the mergers accrued to the merged parties and not the public interest.

In all cases, the pre-merged companies had made commitments to upgrade the Public Switched Telephone Networks, (PSTN) with fiber optics for broadband. In every case, post-merger, SBC (now AT&T) or Bell Atlantic (now Verizon) closed down whatever was being previously deployed, even though there were state-alternative regulation plans to fund these networks via increases to local rates, tax perks, etc. And there have been no audits, refunds, or serious penalties in any state, much less by the FCC.

And this started in the 1990’s, 25 years ago.

- SBC (Southwestern Bell)-Pacific Telesis Merger: In 1993, Pacific Bell had committed to spend $16 billion and rewire 5.5 million homes in California by 2000. By 1997, after the SBC merger, SBC closed all previous broadband commitments prematurely, with only a fraction of the money spent and no finished fiber-based homes deployed.

- SBC-SNET Merger: SNET, the state-based utility for Connecticut, had stated it would spend $4.5 billion and deploy “I-SNET” to the entire state to be completed by 2007. SNET rolled out cable services, which were closed post-SBC merger of 1998; the networks were abandoned and competitors were blocked from using them.

- NYNEX-Bell Atlantic Merger: Bell Atlantic had stated it would spend $11 billion on 8.75 million fiber optic-based upgraded homes by 2000. NYNEX claimed it would have 1.5–2 million fiber optic based homes completed by 2000. Post merger, 1996, all projects were canceled.

Competition and Broadband: SBC-Ameritech and Bell-Atlantic-GTE (creating Verizon) mergers were both predicated on the commitments of companies to compete outside their own territories with all of the other Bell companies.

- SBC-Ameritech Merger: (Illinois, Indiana, Ohio, Wisconsin, and Michigan) The company committed to compete in 30 cities outside their region by 2002. The company also committed to Project Pronto, to spend $6 billion so that “80 percent of SBC’s United States wireline customers in three years”… “moving many customers from the existing copper network to a new fiber network.”

- Outcome: There was no serious competition outside the companies’ territories; The FCC’s commitments only required “at least 3 unaffiliated customers” in a market. Project Pronto was never completed.

- Bell Atlantic-GTE-(Verizon) Merger of 2000 claimed they would “spend a minimum of $500 million to provide competitive local service, including traditional local telecom services and advanced services, outside of its service areas, in 24 cities, and will provide competitive local service to at least 250,000 out-of region customer lines.”

- Outcome: The company never seriously competed outside its region either in local service or ‘advanced’ services, and there are questions if they actually spent the money.

Buying the Long Distance Competitors: AT&T-SBC and Verizon-MCI, 2005

- The FCC wrote: “The mergers should result in substantial cost savings, which should benefit consumers throughout the country.”

- Outcome: AT&T and MCI were the 2 largest competitors and both were sold; their previous long distance clients received large rate increases, as did the incumbent local and other services in the majority of states. The 2 almost simultaneous mergers reduced competition, as well as the political-balance as AT&T and MCI acted as a competitive voice balancing the incumbents.

AT&T-BellSouth

- AT&T-BellSouth Merger: Committed to providing “Internet access service at speeds in excess of 200 kbps in at least one direction) to 100 percent of the residential living units in the AT&T/BellSouth in-region territory by then end of 2007”. The company also committed to sell DSL service for $10.00 to new customers. (Note: 200 kbps was the FCC’s broadband standard at the time.)

- Outcome: Most customers were not offered $10.00 DSL and the company never fulfilled providing 100% of their territories (in 22 states) with broadband capable of 200 kbps in one direction.

- Outcome: AT&T currently controls the state utilities of 21 states.

=================================

Note: Click for the original summary with reference quotes, first published August 2, 2010, then by Public Knowledge.

For full references and footnotes see The Book of Broken Promises now a free download.